Download

Abstract

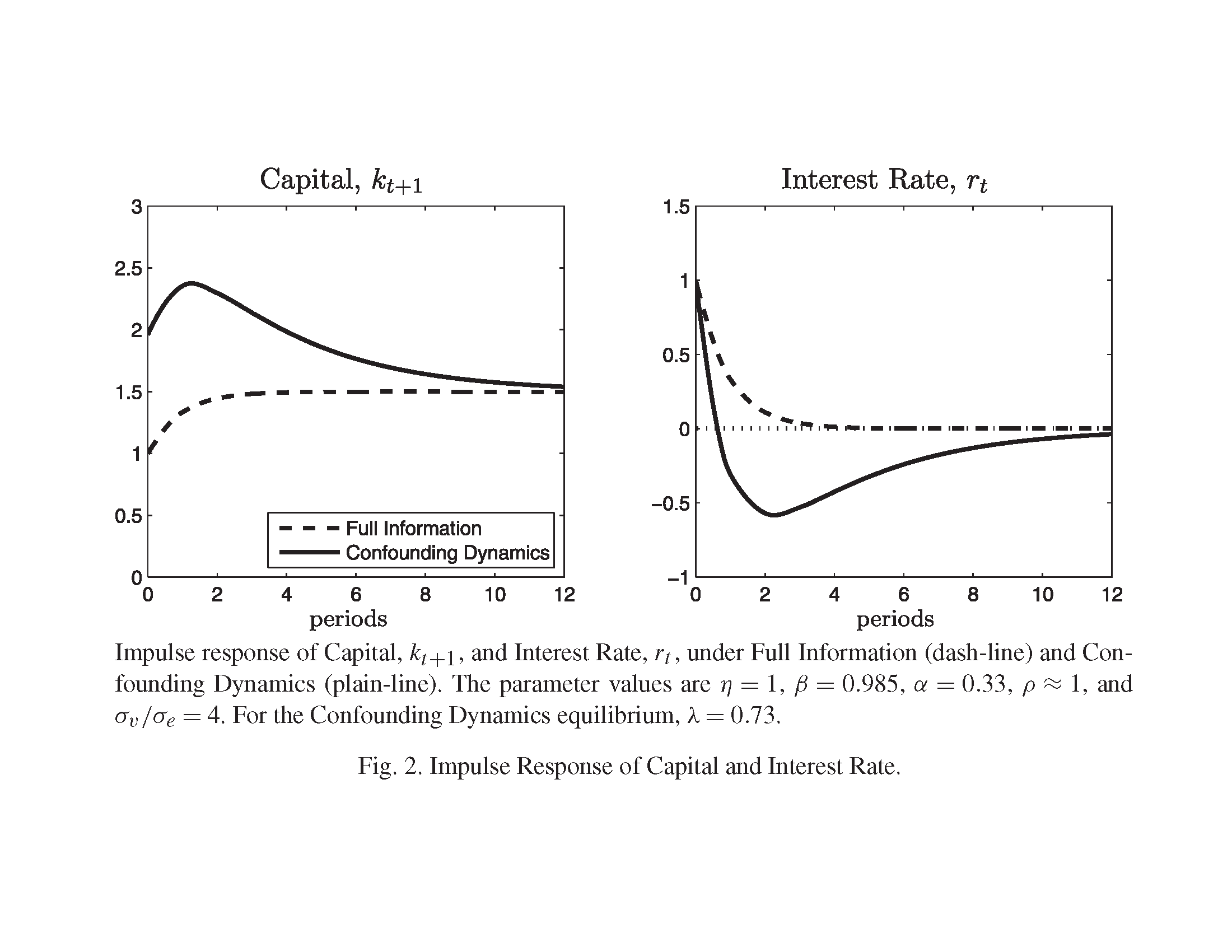

In the context of a dynamic model with incomplete information, we isolate a novel mechanism of shock propagation. We term the mechanism confounding dynamics because it arises from agents’ optimal signal extraction efforts on variables whose dynamics — as opposed to super-imposed noise — prevents full revelation of information. Employing methods in the space of analytic functions, we are able to obtain analytical characterizations of the equilibria that generalize the celebrated Hansen-Sargent optimal prediction formula. Our main theorem establishes conditions under which confounding dynamics emerge in equilibrium in general settings. We apply our results to a canonical one-sector real business cycle model with dispersed information. In that setting, confounding dynamics is shown to amplify the propagation of a productivity shock, producing hump-shaped impulse response functions.

Figure 2: Impulse Response of Capital and Real Interest Rate in RBC Model with Confounding Dynamics

Citation

Rondina, Giacomo and Todd B. Walker, 2021. “Confounding Dynamics.” Journal of Economic Theory 196: 1-33. https://doi.org/10.1016/j.jet.2021.105251 .

Related material

- Frequendy Domain Primer - A collection of results and examples to get started on frequency domain methods employed in the paper.