Download

Abstract

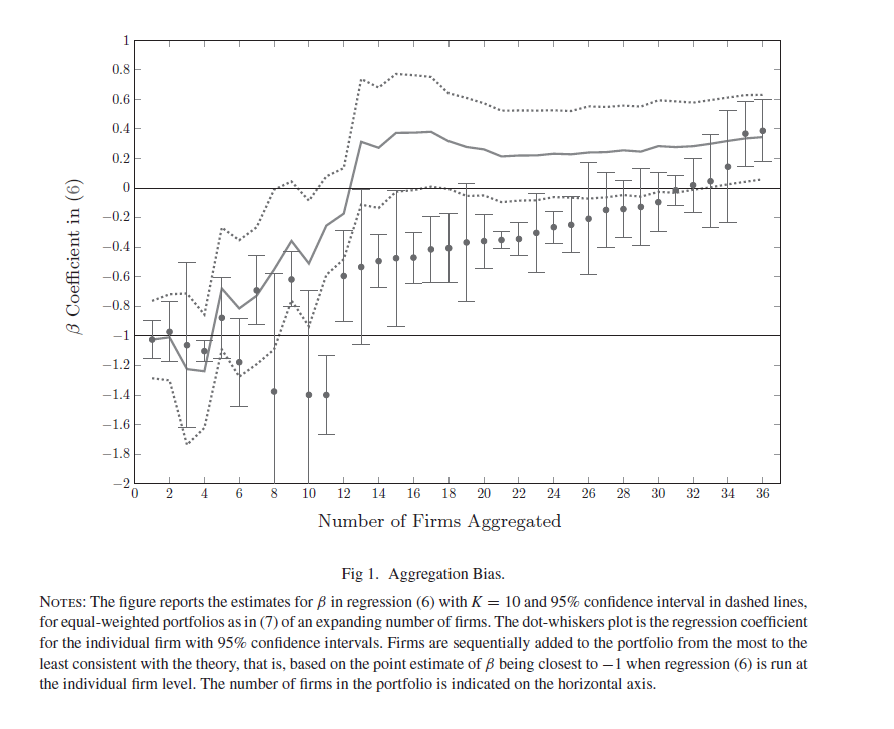

Under the assumption of incomplete information, idiosyncratic shocks may not dissipate in the aggregate. An econometrician who incorrectly imposes complete information and applies the law of large numbers may be susceptible to information aggregation bias. Tests of aggregate economic theory will be misspecified even though tests of the same theory at the micro level deliver the correct inference. A testable implication of information aggregation bias is “Samuelson’s Dictum” or the idea that stock prices can simultaneously display “microefficiency” and “macroinefficiency;” an idea accredited to Paul Samuelson. Using firm-level data from the Center for Research in Security Prices, we present empirical evidence consistent with Samuelson’s dictum. Specifically, we conduct two standard tests of the linear present value model of stock prices: a regression of future dividend changes on the dividend-price ratio and a test for excess volatility. We show that the dividend price ratio forecasts the future growth in dividends much more accurately at the firm level as predicted by the present value model, and that excess volatility can be rejected for most firms. When the same firms are aggregated into equal-weighted or cap-weighted portfolios, the estimated coefficients typically deviate from the present value model and “excess” volatility is observed; this is especially true for aggregates (e.g., S&P 500) that are used in most asset pricing studies. To investigate the source of our empirical findings, we propose a theory of aggregation bias based on incomplete information and segmented markets. Traders specializing in individual stocks conflate idiosyncratic and aggregate shocks to dividends. To an econometrician using aggregate data, these assumptions generate a rejection of the present value model even though individual traders are efficiently using their available information.

Figure 1: Aggregation Bias

Citation

Choi, Yongok, Giacomo Rondina, and Todd B. Walker, 2023. “Information Aggregation Bias and Samuelson’s Dictum.” Journal of Money Credit and Banking 55(5): 1119-1145. https://doi.org/10.1111/jmcb.13010 .

Related material

- Appendix - Additional empirical results.