Download

Abstract

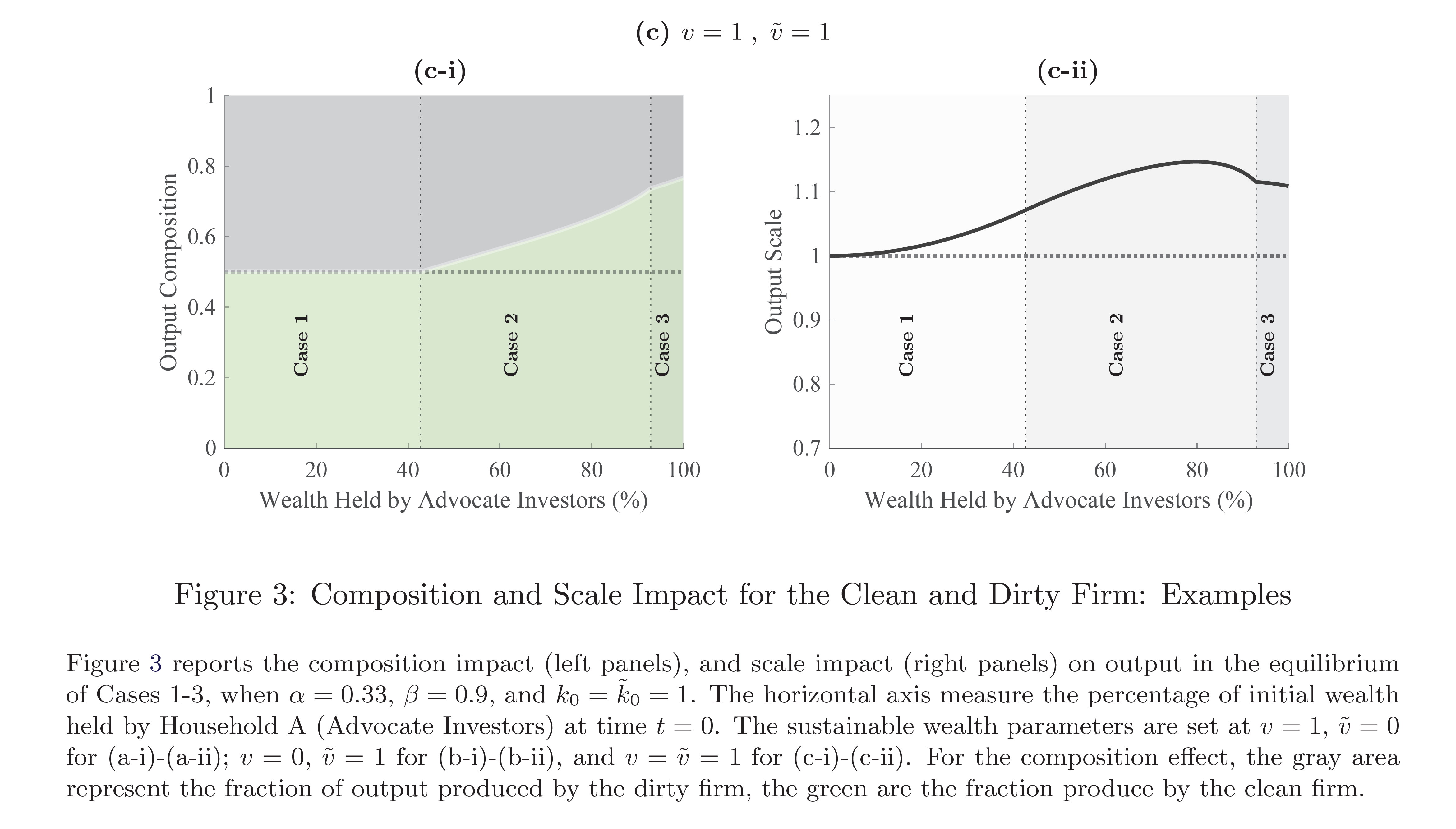

We investigate under what conditions sustainable investing—financial investors who like (resp. dislike) holding assets that they believe have a positive (resp. negative) environmental/ societal impact— alter the allocation of capital between clean and dirty firms in a dynamic general equilibrium framework. We show that investors with preferences for sustainable investing can have both a composition and a scale impact on output, but the magnitude, the direction, and the timing of the impacts crucially depend on the size of sustainable investors in terms of stock market wealth, their investment horizon, and the distribution of firms across sustainability scores. While sustainable investing is shown to eventually impact capital allocation in favor of clean firms in the long run, it might take a long time before the positive impact materializes.

Figure 3: Output Composition and Scale Impact for Clean and Dirty Firm

Citation

Xintong Li and Giacomo Rondina, 2023. “Sustainable Investing in General Equilibrium,” mimeo UCSD