Introduction

The course is a short introduction to the analytical tools and basic results in the theory of economic sustainability from a macroeconomic perspective. The class begins by reviewing dynamic decision-making in continuous time, efficiency, and intergenerational equity. It then reviews the axiomatic approach to intergenerational preferences and presents alternative sustainability criteria, which are subsequently applied to macroeconomic models with non-renewable and renewable resources, and with reproducible capital. It finally explores the implications of sustainability criteria for national accounting practices.

The lectures were prepared for the 2022 Summer School of the Italian Association of Environmental and Resource Economists held at the University of Urbino (Italy).

Lecture 1: Dynamic Decision-Making, Efficiency, and Intergenerational Equity

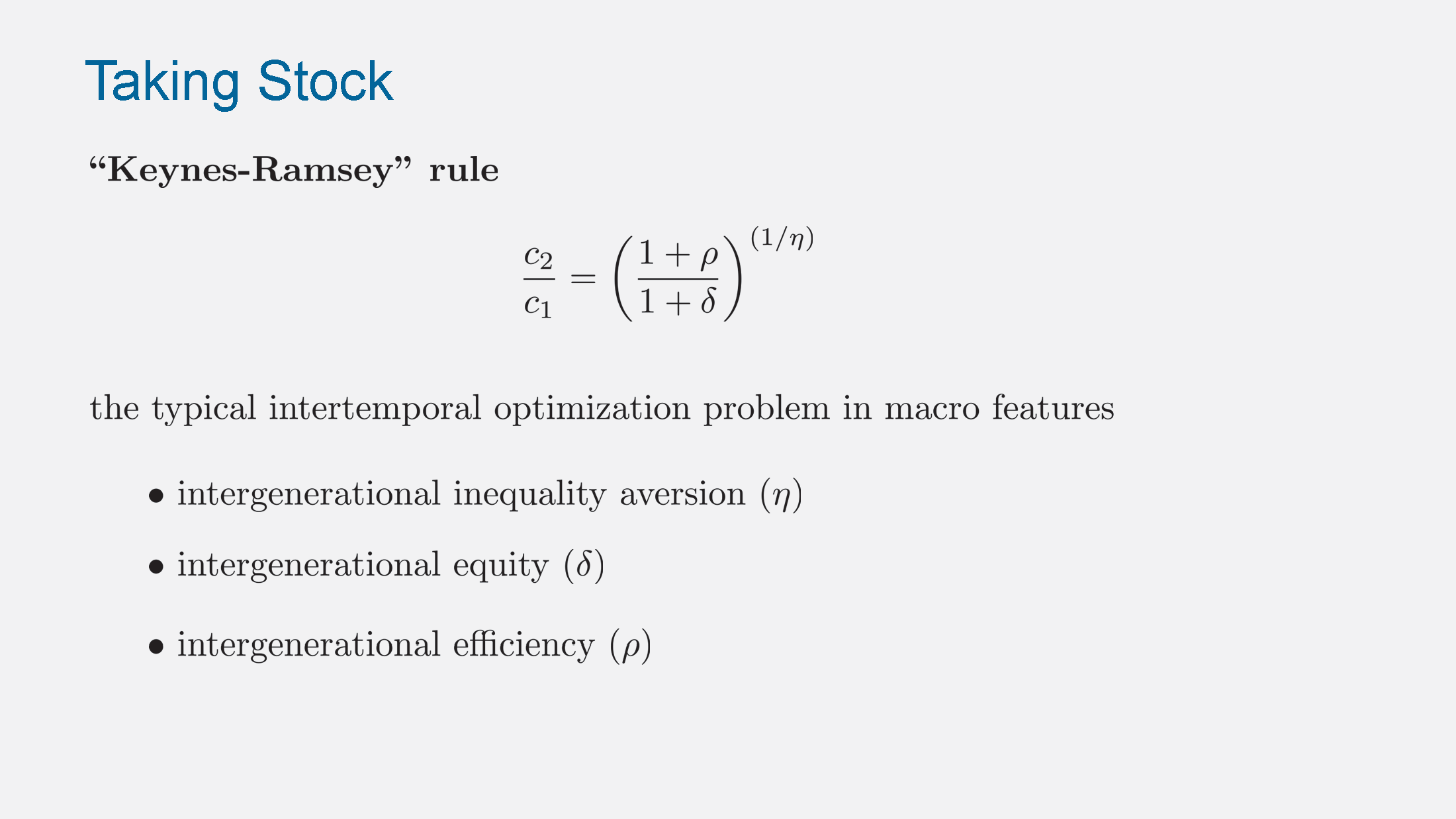

Lecture 1 presents a review of dynamic decision-making in continuous time, the competing notions of efficiency and intergenerational equity, and an overview of the macroeconomic approach to sustainability.

- Lecture notes

- Reference: “Valuing the Future: Economic Theory and Sustainability” by Geoffrey M. Heal, Columbia University Publishing (1998).

Lecture 2: Sustainability Criteria

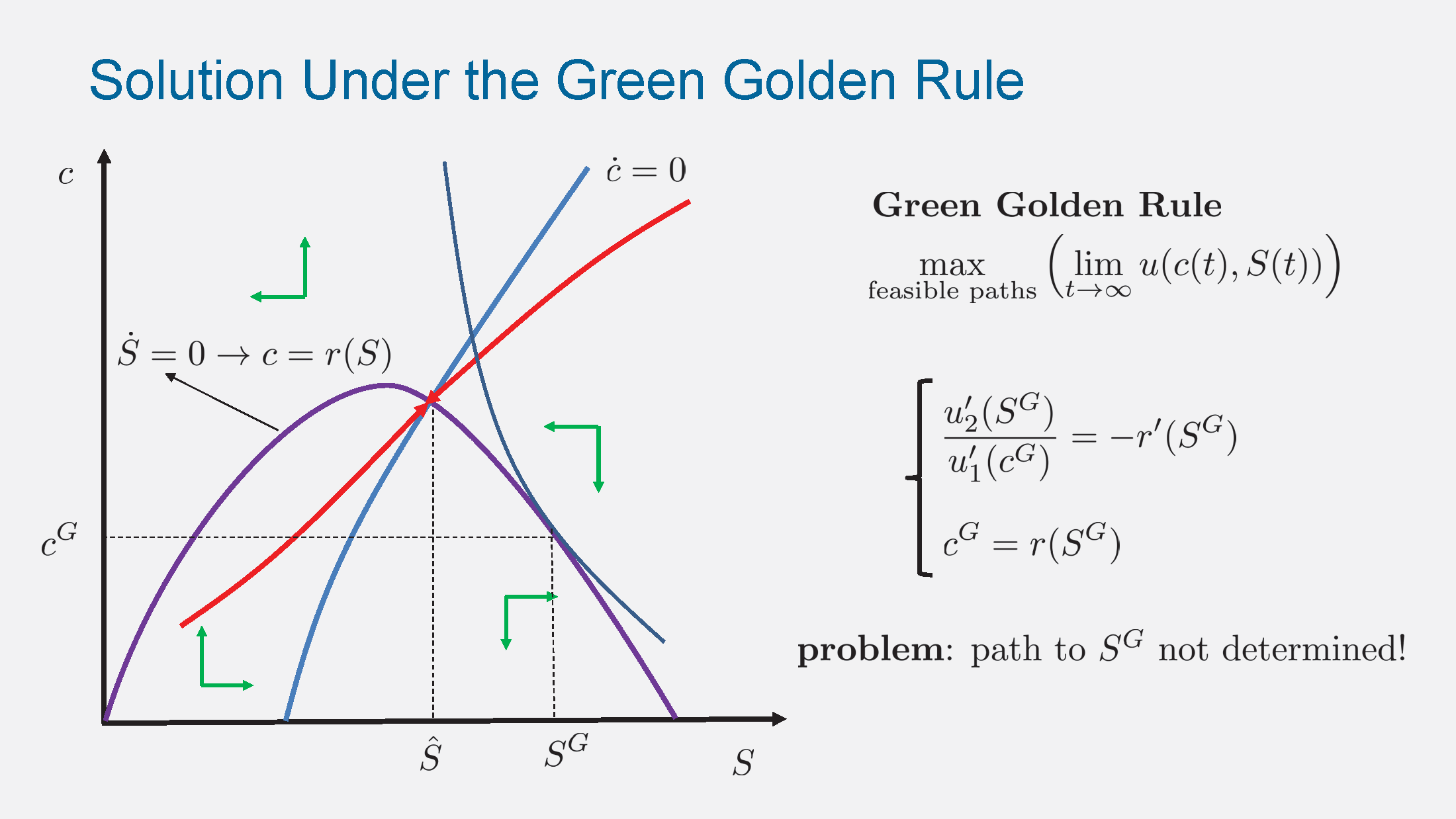

Lecture 2 reviews the axiomatic approach to intertemporal preferences and lays out four sustainability criteria: undiscounted utility (Ramsey criterion); maximin (Rawls criterion); the Green Golden Rule; and the Chichilnisky criterion. The criteria are applied to dynamic models with non-renewable and renewable resources.

- Lecture notes

- Reference: “Valuing the Future: Economic Theory and Sustainability” by Geoffrey M. Heal, Columbia University Publishing (1998).

Lecture 3: Sustainability with Reproducible Capital

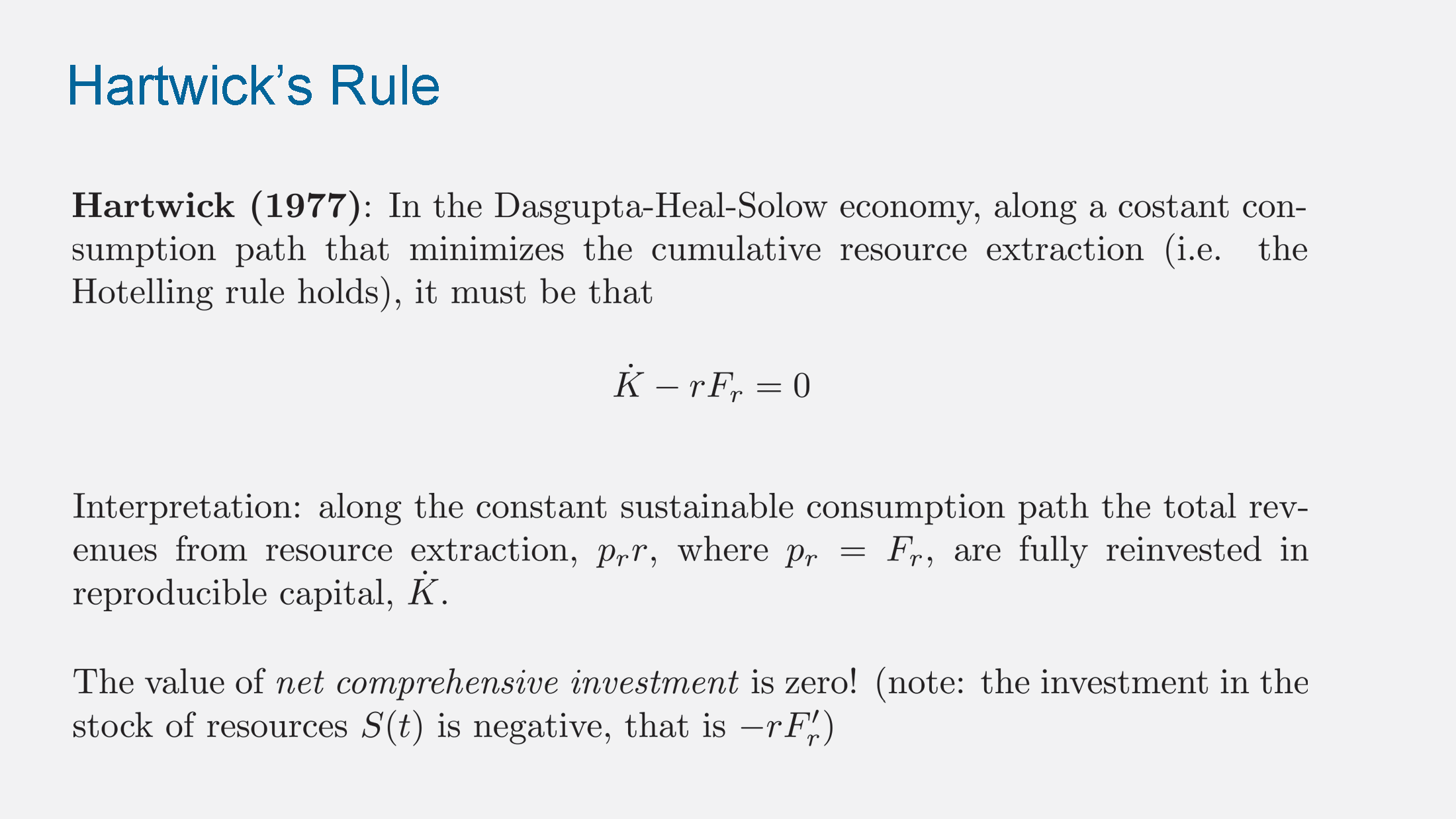

Lecture 3 studies the Daspupta-Heal-Stiglitz-Solow model of growth with reproducible capital and natural resources and applies to it the sustainability criteria developed in Lecture 2. It reviews the Hartwick’s Rule and relates that to sustainability and genuine savings.

- Lecture notes

- Reference: “Valuing the Future: Economic Theory and Sustainability” by Geoffrey M. Heal, Columbia University Publishing (1998).

Lecture 4: Measuring What Matters: Sustainability and National Accounting

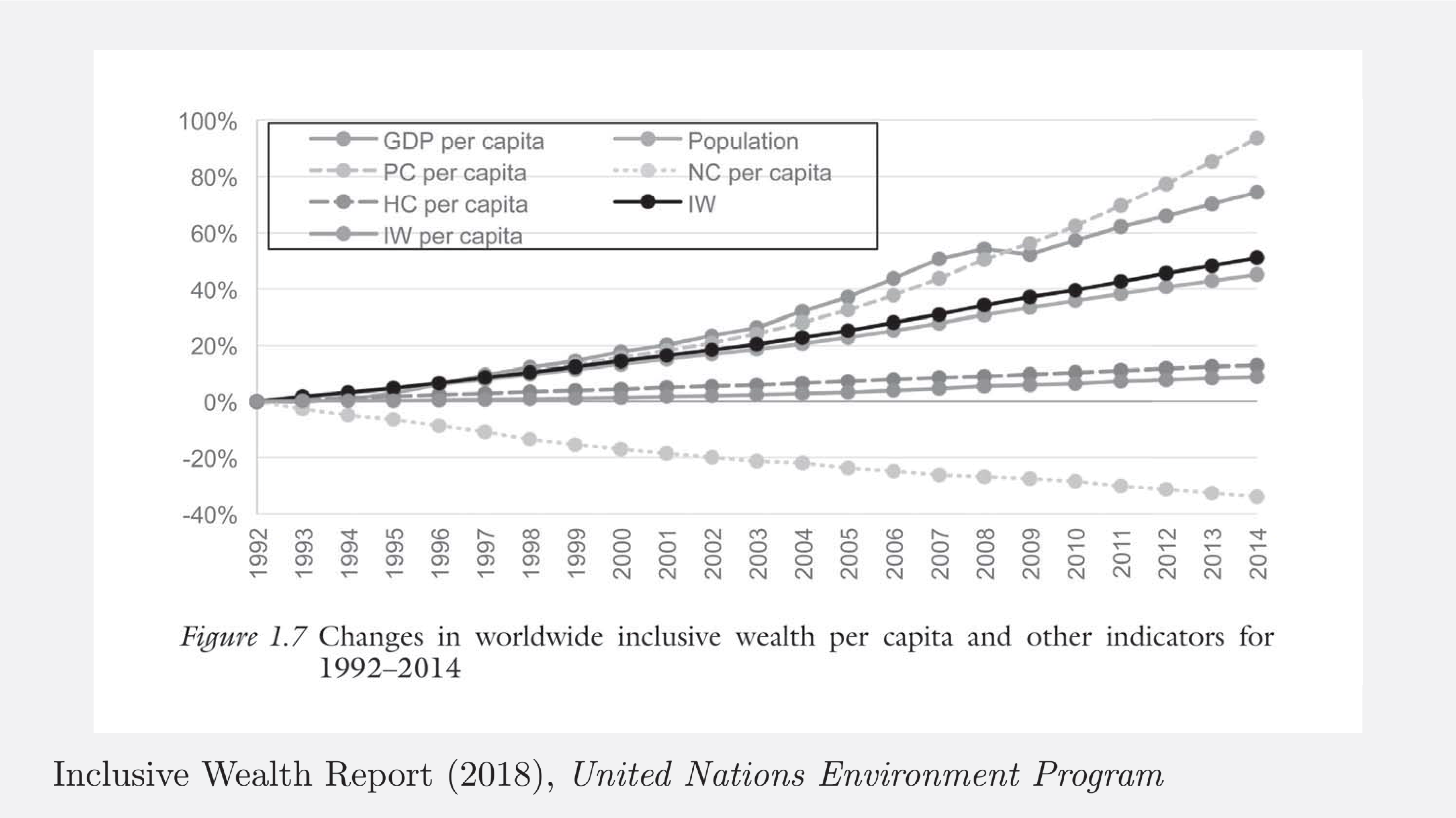

Lecture 4 presents a short introduction to the theory of Comprehensive National Accounting and discusses challenges and opportunities for the future.

- Lecture notes

- Reference: “Valuing the Future: Economic Theory and Sustainability” by Geoffrey M. Heal, Columbia University Publishing (1998).